Ever wonder how prepaid card rewards get spent? We’ve conducted research that shows just how participants are spending their rewards.

Sometimes research participants want more than just cash or points. They want an experience that aligns with their motivations. Rewards should enable recipients to create lasting memories to drive meaningful engagement. Our data on how people use prepaid card rewards worth $100 or less shows that flexible reward spending options unlock memorable experiences, in ways that normal rewards can’t.

In this article, we’ll discuss:

- Over $15 Million analyzed across key spending categories

- Prepaid card rewards create more satisfying experiences than cash

- Enabling experiences over obligations

- Prepaid card rewards create seamless digital redemption

- Choosing the right incentive drives engagement

- Prepaid cards gift lasting impact

When creating rewards, ensure they connect with people’s interests rather than just practical needs. Virtual prepaid cards can give you an advantage by enabling participants to pay for meaningful moments, showing that your brand values them, and leaving a lasting impression beyond just financial transactions.

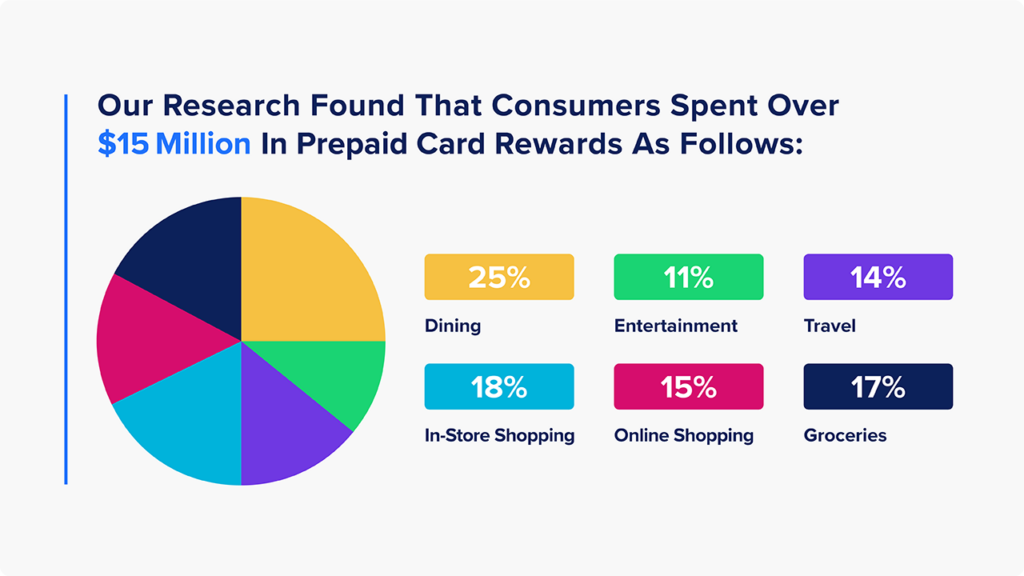

Over $15 Million Analyzed Across Key Spending Categories

We analyzed how people use Prepaid Visa and Mastercards cards in the US when they have the freedom to spend their funds on anything. Our research found that consumers spent the prepaid card rewards as follows:

- Dining: 25%

- Entertainment: 11%

- Travel: 14%

- Shopping in stores: 18%

- Online shopping: 15%

- Groceries: 17%

A significant portion of the rewards went toward necessities such as food and transportation. Over a third of the rewards were used for discretionary categories related to hospitality, leisure, and recreation. This shows how prepaid cards can unlock memorable moments compared to cash transfers.

Prepaid Visa and Mastercards enable more satisfying and engaging uses focused on creating memories compared to rewards paid into general accounts via transfers to cash apps and online retailers like Amazon.

Prepaid Card Rewards Create More Satisfying Experiences Than Cash

We compared how people spend their rewards when they’re delivered to their bank accounts versus to when they receive prepaid Visa cards. While digital transfers to apps like Paypal or Amazon are easy to redeem, the money tends to just get lost in their regular budgets and is quickly forgotten.

When it comes to using prepaid card rewards, recipients have a different experience. Feedback shows that rewards feel more like a special treat compared to bonuses that are just deposited into their accounts. Because of “mental accounting,” having distinct caches of funds creates a sense of satisfaction and a memorable impact that cash incentives don’t provide.

Why customers love Visa rewards.

Instead of just forgettable transactions, prepaid card rewards allow for small luxuries like dining out, salon trips, or concert tickets. The convenience of digital redemption strengthens positive associations with research by making it possible to indulge in special treats using just a mobile wallet.

Enabling Experiences Over Obligations

Visa and Mastercards provide people with the flexibility to spend their money at different places, unlike retail gift cards that restrict usage to certain stores. This makes it easier for them to support local businesses or make quick purchases using a mobile wallet, which creates positive associations.

Seven benefits of virtual Visa rewards.

Every time people use the branded, specially loaded cards they received as rewards, they remind themselves of their positive research experience. Instead of more work clothes or household supplies, these cards give them the chance to buy things they might not usually prioritize, like something fun and indulgent that creates happy moments and memories.

Prepaid Card Rewards Create Seamless Digital Redemption

After analyzing thousands of prepaid Visa cards with low balances, we can see that people are spending rewards money easily by tapping and paying with their phones. Virtual cards added to digital wallets, along with other payment options, make transactions really smooth – no need for physical cards.

Adding virtual rewards to mobile wallets makes things easier when everyday situations happen, like realizing you forgot your wallet at home when you’re in the checkout line at the supermarket. Mobile wallets and prepaid card rewards add extra flexibility that regular payment cards don’t have.

Through focus groups and interviews, we heard stories of how virtual Visa cards were really important when people forgot their wallets and needed to buy gas or other items. Using the mobile feature saved them from making extra trips. For some people who aren’t as used to digital tools, prepaid card rewards gave them a good introduction to using tap-and-pay options.

Choosing the Right Incentive Drives Engagement

Virtual Visa and Mastercards meet fundamental needs for flexibility, convenience, and life experiences over quickly forgotten cash transfers. This creates positive memories from research participation such that taking part in research equates to meaningful moments rather than just some cash that went into a bank account.

More on market research firms moving toward Visa reward cards for participant payment.

At the same time, the Visa payment system makes it easy to use the cards anywhere in the world, all while keeping the program’s branding in mind after each use.

More on the global virtual Visa.

As companies look for new and effective ways to incentivize and motivate, prepaid Visa debit cards are becoming a popular choice, especially as traditional point and cash-back systems start to lose their impact.

Prepaid Cards Gift Lasting Impact

In a world of disappointing cash-back offers and difficult-to-use loyalty points, prepaid Visa debit cards offer a simple way to spend money. With easy enrollment in digital wallets and wide-acceptance by many merchants, recipients can use the cards to unlock meaningful moments that other types of incentives, like general account funds, can’t provide.

When looking to get people to take action and show support for your research or loyalty programs, make sure your rewards truly resonate with their interests and passions. It’s not just about the material value, it’s about the emotions and connections the rewards create. By aligning incentives with people’s intrinsic motivations, you can build long-lasting engagement and loyalty, leading to ongoing, long-term success.

Contact us today to learn more about the power of prepaid card rewards.